Call for ESG Instead of Divestment?

In the face of a conflict of interest complaint, student pressure, and a legal complaint filed with the Tennessee Attorney General, Chancellor Daniel Diermeier of Vanderbilt University has resolutely maintained his stance of “principled neutrality” on divestment. According to his estimation, and many other university administrators across the country, divestment represents an activist position. It is perceived as a positive action a university takes, making a stand for a particular political position which may violate the ethical requirements of an ostensibly nonpartisan school. This claim of neutrality is used to justify inaction because, according to the logic of the argument, to choose divestment represents a deviation from what is acceptable from university administrations.

However, an inconsistency lies at the heart of this argument: choosing not to divest is just as active a position. Indeed, one’s complicity with an unjust institution is a choice just as much as removing that complicity. It would be like saying, “I hit you with my car, but it wasn’t really my decision because I didn’t press the accelerator, I just didn’t press the brakes.” The whole line of reasoning ignores the fact that resisting divestment is just as much a commitment as embracing it (the only difference is that one of these options helps to fight an extinction-level threat while the other reinforces it).

Nevertheless, no matter how much you may try to explain its inconsistency, the principled neutrality stance sounds good enough that it can be used as a shield, despite its logical fallacies. Given this reality, it is important to consider how, as divestment activists, it is possible to circumvent these rationales in favor of apathy.

The easiest way to do this is to alter the messaging associated with divestment. Because of the connotations of “divestment” as a concept, it is understandable that image-focused university administrators may be hesitant to comply. There is no doubt that if a university’s divestment were picked up by certain news sources, it could lead to a PR disaster. Understanding that the fear of a tarnished image is at the root of resistance opens up pathways to achieve divestment without simultaneously incurring the risk of public retaliation.

The easiest way to do this is to alter the messaging associated with divestment. Because of the connotations of “divestment” as a concept, it is understandable that image-focused university administrators may be hesitant to comply. There is no doubt that if a university’s divestment were picked up by certain news sources, it could lead to a PR disaster. Understanding that the fear of a tarnished image is at the root of resistance opens up pathways to achieve divestment without simultaneously incurring the risk of public retaliation.

For divestment activists pressuring image-conscious institutions, semantics and messaging are critical, leverageable tools that can be used to get in the door and inspire good faith conversations.

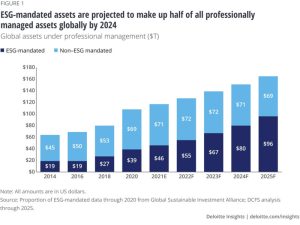

One way to transform the conversation is to use the language of ESG investing. ESG is incredibly popular at the moment: ESG-mandated assets reached nearly $50 trillion in 2021 and are expected to grow to nearly $100 trillion by 2025. Most importantly, ESG does not have the same political connotation as divestment. This means that institutions hesitant to make “political” choices would likely be more willing to engage in ESG investment rather than fossil fuel divestment, even if the results are the same. And, administrators will be aware that ESG funds are profitable. In fact, ESG is more profitable than unrestricted investments because it considers critical facets of a company beyond its mere financials (gasp). Because it has a proven track record and has been accepted widely as nonpartisan, administrators have no legitimate reason to avoid ESG.

One way to transform the conversation is to use the language of ESG investing. ESG is incredibly popular at the moment: ESG-mandated assets reached nearly $50 trillion in 2021 and are expected to grow to nearly $100 trillion by 2025. Most importantly, ESG does not have the same political connotation as divestment. This means that institutions hesitant to make “political” choices would likely be more willing to engage in ESG investment rather than fossil fuel divestment, even if the results are the same. And, administrators will be aware that ESG funds are profitable. In fact, ESG is more profitable than unrestricted investments because it considers critical facets of a company beyond its mere financials (gasp). Because it has a proven track record and has been accepted widely as nonpartisan, administrators have no legitimate reason to avoid ESG.

Using the talking point of ESG investment, then, can serve as an excellent way to encourage conversation and remove the immediate scepticism that prevents open discourse between activists and administrators. Because ESG has achieved external markers of validity and impartiality, it is better equipped to dismantle the fallacious stance of neutrality and the concerns of bad PR. “After all,” might think the administrator, “imagine how much good press we could get if our endowment was consistent with the UN Principles of Responsible Investment!”

Using the talking point of ESG investment, then, can serve as an excellent way to encourage conversation and remove the immediate scepticism that prevents open discourse between activists and administrators. Because ESG has achieved external markers of validity and impartiality, it is better equipped to dismantle the fallacious stance of neutrality and the concerns of bad PR. “After all,” might think the administrator, “imagine how much good press we could get if our endowment was consistent with the UN Principles of Responsible Investment!”

It makes sense from a financial perspective. It makes sense from an administrative perspective. It makes sense from a human perspective. By presenting divestment as ESG investment, climate activists can remove the semantic burdens that have been constructed to prevent our success for the benefit of our movements, our schools, and our world.

RCC Fellow – Ethan Thorpe – Vanderbilt University

RCC Fellow – Ethan Thorpe – Vanderbilt University

RCC Fellow Ethan Thorpe is a junior at Vanderbilt University studying Law, History, and Society with a minor in Philosophy. His goal is to pursue a JD, ultimately working in public interest environmental law to establish a legal precedent that will be integral to a legal and regulatory framework to fight climate change and environmental degradation.